2025 Form 1041 Instructions. Skip to main content ncdor experiencing. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d.

Analyze estate documents for tax implications; Application for automatic extension of time (01/2025) 7004n.

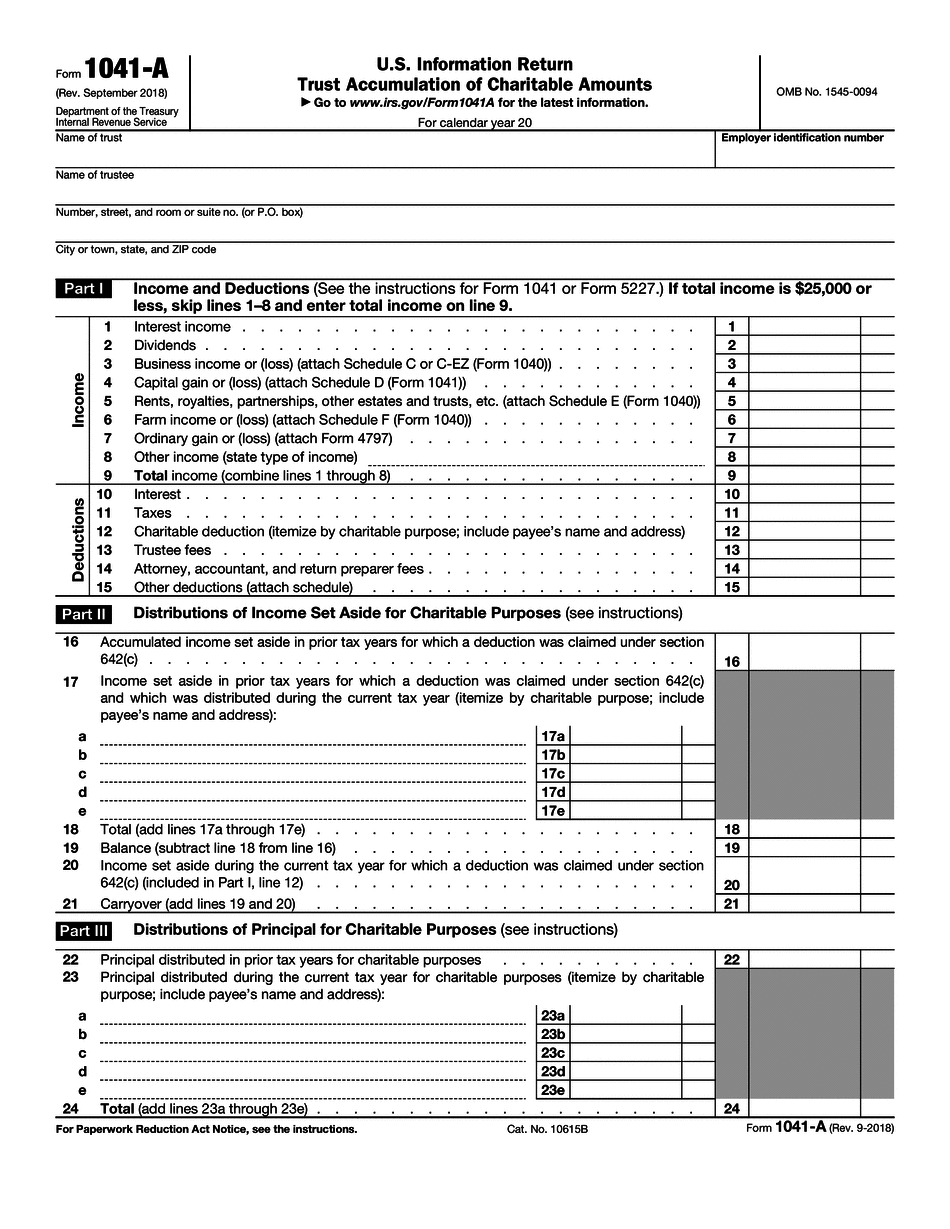

1041 a 20182024 Form Fill Out and Sign Printable PDF Template, 2025 electing small business trust tax calculation worksheet. Find irs mailing addresses by state to file.

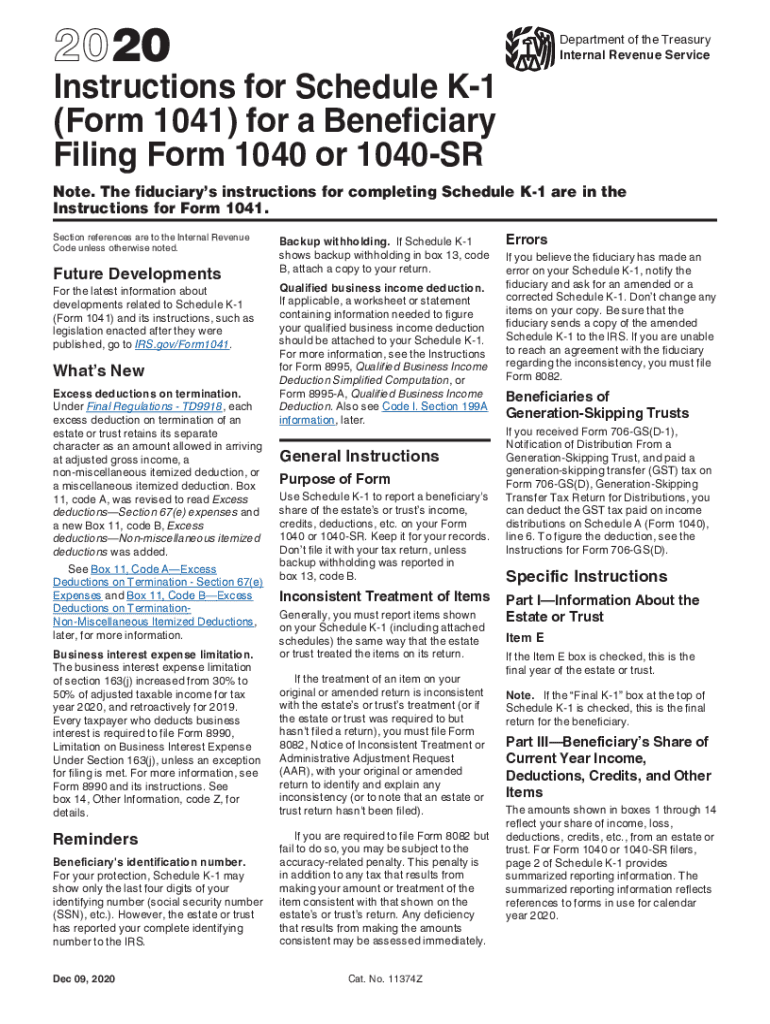

K 1 Instructions 20202024 Form Fill Out and Sign Printable PDF, Underpayment of estimated income tax by individuals, trusts, and estates. Application for automatic extension of time (01/2025) 7004n.

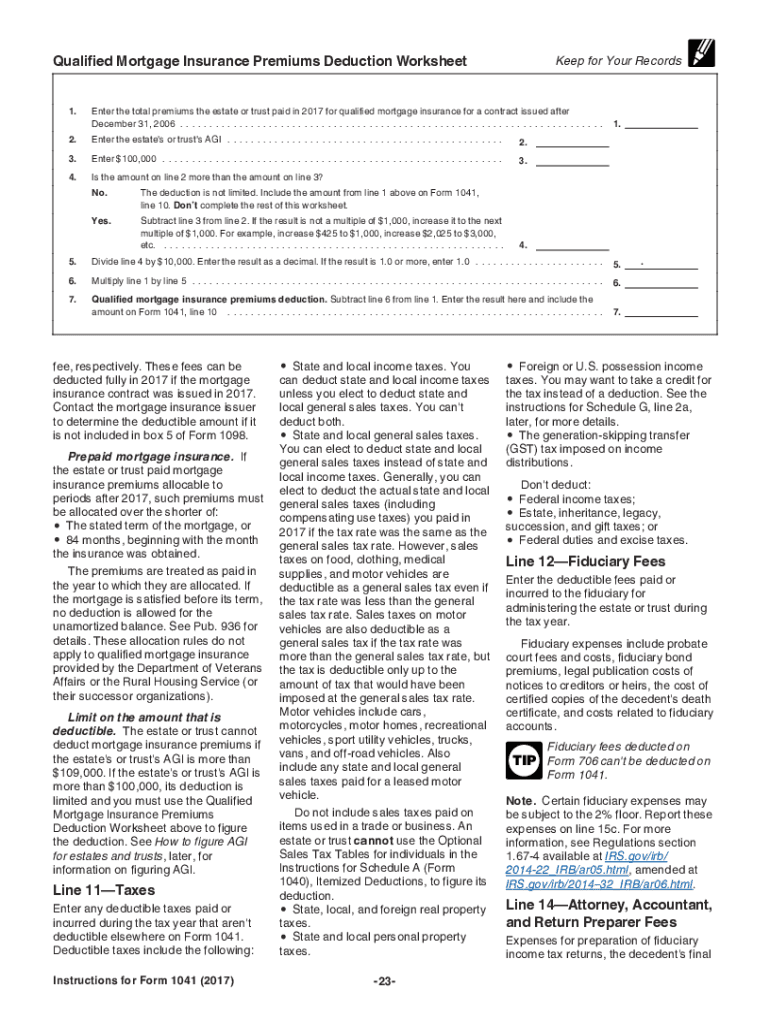

What Expenses Are Deductible On Form 1041 Why Is, The depreciation for the remainder of the. When filling out form 1041, you must also attach one or more schedules to it.

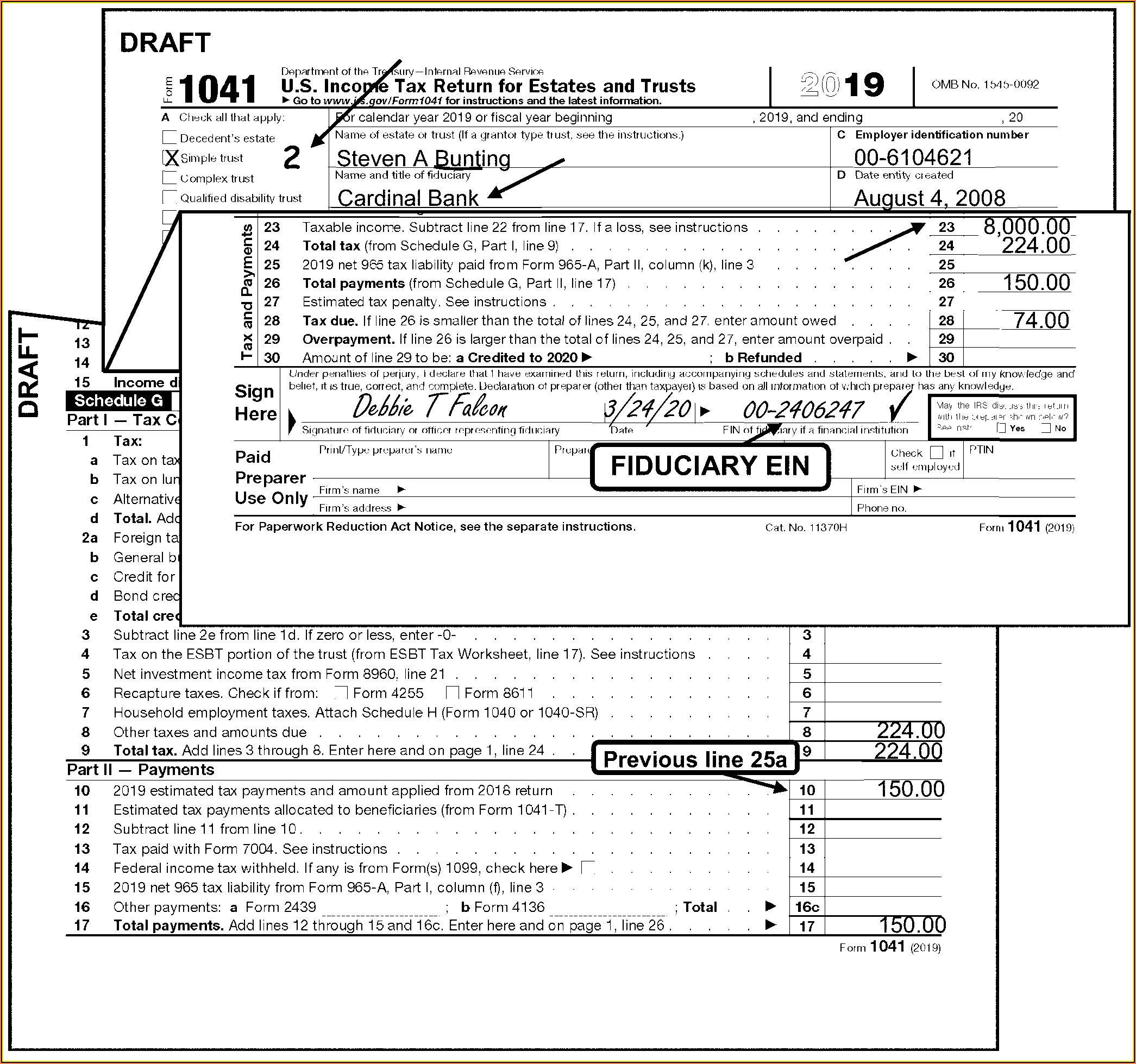

1041 20172024 Form Fill Out and Sign Printable PDF Template signNow, Don’t use this worksheet if the estate or trust must complete schedule d (form 1041). Updated on december 20, 2025.

Irs Form 1041 Instructions 2017 Form Resume Examples GM9OOwk9DL, Enter the amount from form 1041, line. Find irs mailing addresses by state to file.

How To Fill Out 1041 K1 Leah Beachum's Template, Application for automatic extension of time (01/2025) 7004n. When filling out form 1041, you must also attach one or more schedules to it.

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT, Complete schedule i if the estate's or trust's share of alternative minimum taxable income (part i,. Underpayment of estimated income tax by individuals, trusts, and estates.

Irs 1041 20202024 Form Fill Out and Sign Printable PDF Template, Here’s a breakdown of the different schedules that can be filed with form 1041: Application for automatic extension of time (01/2025) 7004n.

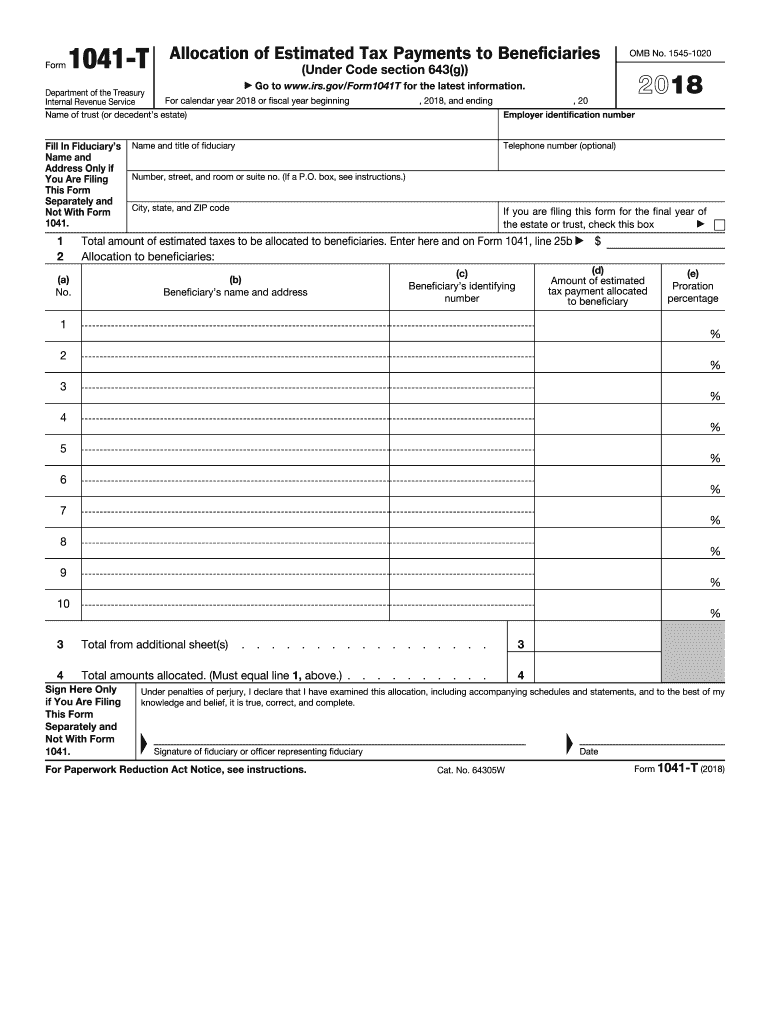

1041 t Fill out & sign online DocHub, The tax rates for each income level range from 1.7% for income not over. When filling out form 1041, you must also attach one or more schedules to it.

Turbotax business 2025 Fill online, Printable, Fillable Blank, Don’t use this worksheet if the estate or trust must complete schedule d (form 1041). Here’s a breakdown of the different schedules that can be filed with.